What is Bad Credit?

In America and the rest of the world, there are three main credit bureaus: Equifax, Experian, and Transunion. These bureaus compute your creditworthiness using different criteria but these criteria are similar across the three. Historically, credit scores were based on the FICO score from the Fair Isaac Corporation. Experian uses its own FICO score, also known as the “Experian/Fair Isaac Risk Model v2,” even though you can still obtain a FICO score from any of the big three credit bureaus. Your credit score is a three-digit number that ranges between 300 and 850 and is calculated using information from your credit report. It is worth noting that being named a bad creditor is highly dependent on your credit score.

VantageScore®, another credit scoring model which was developed by the three main credit bureaus (Experian, TransUnion and Equifax), also uses a scale ranging from 300 to 850. But its definitions associated with each score range vary slightly.

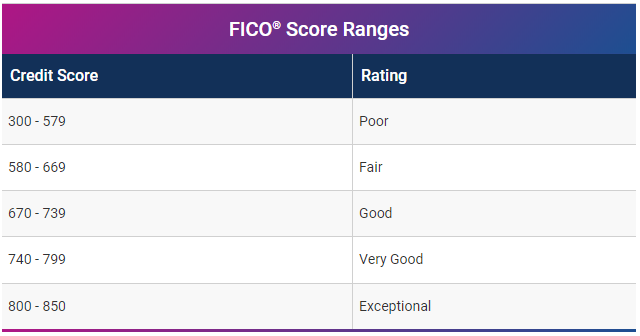

On the FICO® Score 8 scale of 300 to 850, one of the credit scores lenders most frequently use, a bad credit score is one below 670. More specifically, a score between 580 and 669 is considered fair, and one between 300 and 579 is poor. The table below offers more detail on where scores fall.

Experian Tweet

Having bad credit indicates that a person has a pattern of paying their debts late and is thus likely to continue this pattern in the future. It usually shows up as a poor credit score. Companies might have a low credit score if they have a history of late payments or are currently struggling financially.

Borrowing money will be difficult for a person (or business) with terrible credit, especially at low interest rates, because of the higher risk they pose to lenders. A business owners personal credit history will count when they apply for a business loan, if their company is a sole proprietorship. The lender will want to know if the business owner is a good debtor even separate from the business and its money, especially if the money is being used to grow the business. Growing the business will incur more expenditure in the long run.

Is it true that it's better to have bad credit than no credit?

Generally, having no credit is preferable than having bad credit, yet both might hold you back. The highest credit cards of today may be out of reach for those with no credit history, and those with a poor score may have problems doing everything from applying for a job to renting an apartment.

A person with no credit history is one who has never applied for a loan, credit card, or other kind of finance. With no credit history, you won’t fulfill the minimal standards for a FICO or VantageScore credit score. No credit history doesn’t mean a zero-credit score. It’s actually nonexistent.

Lenders assess individuals based on how they’ve utilized credit in the past. If you have no previous credit history, lenders will see you as a higher risk. It may make it more likely that a lender may reject your application for a loan or credit card. As noted, both no credit and poor credit might hold you back when you apply for financing. Yet bad credit is often worse than no credit in the eyes of a lender.

More lenders may be willing to do business with a credit unknown vs someone who already has a checkered background. Because of this, having no credit is preferable than having bad credit. The effects of poor credit might be more severe. For example, some lenders may be ready to grant you a mortgage with no credit. Yet securing a house loan with credit ratings that fall below a lender’s cutoff mark may be difficult.

However, there are several credit cards meant for those who are just getting started with credit, including student credit cards and credit cards for persons with no credit history.

What loan options are available to someone with bad credit?

The loans available to those with bad credit are standard term loans, collateral-based loans, or unsecured loans. However, the terms and conditions may be extremely stringent.

Lenders that will work with you despite your low credit score and provide you with a loan will often charge you a higher interest rate. When deciding whether or not to provide a loan, financial institutions look primarily at the borrower’s credit score and creditworthiness. However, you may use poor credit loans to improve your credit score and open the door to better loan conditions and more financial prospects in the future.

It may be simpler to qualify with lenders whose decisions are based on more than just your FICO Score. In addition to credit history, income, and job history are all factors that certain lenders may consider. This can also include your level of education, which works as a future-looking lending practice, as it relates to your potential to earn income in the future.

Even if you can’t acquire a good annual percentage rate (APR) due to a low credit score, you may still be able to discover rates that are significantly cheaper than choices like credit cards or payday loans. The top bad credit business loans we’ve found feature lenient qualification requirements and competitive interest rates.

Apply for a loan preapproval now. The prequalification procedure will not hurt your credit score since it generates only a soft inquiry, allowing you to see whether you are likely to be accepted for a loan and what rates you could be eligible for. This might help you determine what you could be eligible for and how much it would cost over time.

Obtaining a business loan when you have bad credit is difficult, but not impossible. If your application for a loan was turned down because of your bad credit, a co-signer may be able to assist you get the money you need. As an added bonus, if you are approved for a bad credit business loan but the rates are too high, you may try applying again with a reliable co-signer. This is due to the fact that financial institutions anticipate more repayment reliability from borrowers who have established positive credit histories. As an added layer of protection for the lender, having a solid credit co-signer is a great idea.

The loans available to those with bad credit are standard term loans, collateral-based loans, or unsecured loans. However, the terms and conditions may be extremely inflexible. Terms for unsecured loans will probably be short term, and payment schedules and penalties may be rather stringent.

Content Provided By:

Chester